Got questions? Get your answers.

With Internet Banking you'll have access to your account(s) 24 hours a day, 7 days a week from the comfort and convenience of your home and office. You'll be able to:

Benefits of Enrolling in Internet Banking

- Check account balance(s)

- Transfer funds between accounts

- Make payments to your Luzerne Bank loan(s) and review loan activity

- Place Stop Payments on accounts

- View account statements - stored securely online for 1 year

- View image of checks and deposit stubs

- View Current Day Information on account(s) - basic account information, current balance, available balance, account interest rate, statement information

Other Services Available with Internet Banking

- Bill Payment - Pay your bills online; no checks, no stamps. Schedule recurring bills or individual bills.

- Mobile Banking - Access Internet Banking more efficiently on your mobile device with Mobile Banking.

- Text Banking - View your account balance(s) and transaction history on your cell phone with Text Banking

- E-Statements - Eliminate mail clutter by receiving your account statements electronically. By signing up for E-Statements you'll receive an email notifying you of when the statement is available on Internet Banking. E-Statements are available online for up to 1 year and are available in several file formats.

How to Sign-up for Internet Banking

To sign up for Internet Banking on-line go to https://myluzernebank.com/login and select Enroll Here.

Here you will be required to enter the following information exactly as we have it on file. If you are not sure what information we have on file you will need to either visit a branch to verify this information.

Next you will set up a 2-step verification using one of the following by selecting Get Started.

To login to your Internet Banking Account you will need to have both your Internet Banking ID and your Internet Banking PIN/Password.

Go to https://myluzernebank.com/login and enter your Internet Banking ID, enter your Internet Banking PIN/Password and click "Submit."

Change PIN/Password

The first time you access your account you will be asked to change your Internet Banking PIN/Password. Your Password must be between 8 and 25 characters using a combination of letters and numbers, upper and lower case.

Watermark

You will be asked to select an image called a Watermark from a gallery of images. This is simply another level of security. Should you login to Internet Banking and the Watermark is not the one you choose double-check that you used the correct Internet Banking ID. If you still do not see your Watermark, contact Internet Banking Support immediately and DO NOT enter any more information on the site.

Change/Confirm Email Address

Finally, you will be asked to change or confirm your email address. This address will be used to notify you of when your E-Statements will be available.

Change ID (optional)

Don't think you can remember the Internet Banking ID we supplied? Click the "Options" tab. This will take you to a page that will allow you to change your Internet Banking ID as well as your email address, watermark image, and Internet Banking PIN/Password.

Setup PIN/Password Reset Question & Answer (optional)

Under the options tab you can also set up your PIN/Password Question & Answer. This will allow you to reset your password should you forget it.

Without the PIN/Password Question & Answer set up only Internet Banking Support can reset your password, and only during business hours. You will not be able to reset your password if your account becomes dormant (after 180 of not logging into your account). If your account becomes dormant you will need to contact Internet Banking Support at ebanksupport@luzernebank.com or 570-320-2020 to have your account reset.

How to Reset Password

When you first setup your Internet Banking Account you should have provided a PIN/Password Reset Question & Answer located under the "Options" tab. (See How to Login to/Set up Internet Banking for directions on how to setup your PIN/Password Reset Question & Answer).

To reset your password, click "Reset Forgotten Password" where you're asked to supply your Internet Banking PIN/Password. You will be asked to provide your Internet Banking ID, email address associated with your account, and an Email Subject line. Click "Submit."

You will receive a confirmation message indicating that you should soon receive an email with instructions on how to reset your PIN/Password.

Open email and follow directions. You will be navigated to a webpage that will ask you to supply your Internet Banking ID, and the answer to your PIN/Password Reset Question. Click "Submit."

You will then be asked to provide a new PIN/Password. Click "Submit." A confirmation message will appear verifying that your password has been reset. Click "Go to Login Page."

If you do not setup the PIN/Password Reset Question & Answer you will need to contact the Internet Banking Support Department at ebanksupport@luzernebank.com or 570-320-2020. Passwords will only be reset during our business hours:

Monday, Tuesday, Thursday, Friday 8:00 a.m. to 5:00 p.m. and Wednesday 8:00 a.m. to 2:00 p.m.; excluding Federal holidays

For this reason it is highly recommended that you setup your PIN/Password Reset Question & Answer.

Dormant accounts (not having logged into your Internet Banking account after 180 days) must be reset by Internet Banking Support.

Zelle®

FAQs

What is Zelle®?

Zelle® is a fast, safe and easy way to send money directly between almost any bank or credit union account in the U.S., typically within minutes1. With just an email address or U.S. mobile phone number, you can send money to people you trust, regardless of where they bank1.

Where is my money?

Recipients must be enrolled with Zelle® to receive their money. Check to see if you’ve received a payment notification via email or text message. If you haven’t received a payment notification, we recommend following up with the sender to confirm they entered the correct email address or U.S. mobile phone number.

Verify the U.S. mobile number or email address the payment was sent to is the same email address or U.S. mobile number that the recipient enrolled with Zelle®.

If the sender entered an incorrect email address or U.S. mobile number, ask them to contact their financial institution’s customer support team for help.

If the sender entered the correct email address or U.S. mobile number and their account has been debited, ask the sender to call their financial institution’s customer support team for assistance locating the payment.

If the sender’s financial institution does NOT offer Zelle® and they used the Zelle® app to send you money, ask them to contact Zelle® support.

I sent money to the wrong person, what should I do?

If the person has not yet enrolled with Zelle®, you can try to cancel the payment. To check whether the payment is still pending, go to your Zelle® activity page in our Luzerne Bank mobile app, find your transaction to see if it is still listed and pending, and if so, choose the payment you want to cancel, and then select “Cancel This Payment.”

If the person you sent money to has already enrolled with Zelle®, the money is sent directly to their bank account and cannot be canceled.

If the payment is no longer pending, please call us immediately at Luzerne Bank – 800-447-9464 so we can help you.

What is my sending limit?

Limits are set to protect you from fraudulent activity.

For Luzerne Bank:

Amount per transaction - $500

Amount per processing day - $500

Amount per processing week - $2,500

Amount per processing month - $10,000

Number of payments per day – 10

Number of payments per week – 70

Number of payments per month - 310

Can I add or change the email address or U.S. mobile number enrolled with Zelle®?

Yes. Log into our mobile app, select “Send Money with Zelle®,” then “Update Contact Information” and update the information enrolled with Zelle®.

How can I tell if the person I sent money to has received it?

Log into our mobile app, click “Send Money with Zelle®,” then click “Activity.” If the payment is listed as “pending,” the recipient has not yet enrolled with Zelle® and has not received the money. If the payment is listed as “Completed,” the money moves directly into their account, typically in minutes1.

Can I enroll multiple bank accounts with Zelle®?

Yes, but you must use a different email address or U.S. mobile number for each bank account you enroll with Zelle®. Since your email address or U.S. mobile number is a unique identifier that tells us where to deposit your money, you need a different email address/U.S. mobile number for each account you enroll with Zelle®.

When I tried enrolling with Zelle®, I received a message saying that I was already enrolled. Why?

There are a couple of reasons why you may be receiving this message:

- Your mobile number or email address is already enrolled with a bank or credit union (which could be at Luzerne Bank).

- Your mobile number or email address is already enrolled with clearXchange.com or the Zelle® app.

(Note to call center representatives: clearXchange® is an online version of Zelle® used for receiving payments from companies. You will probably receive very few calls about clearXchange.com).

If you are unsure where you are enrolled, please contact Zelle® customer support at 844-428- 8542.

I’ve been scammed, what should I do?

Contact Luzerne Bank ASAP.

I’m enrolled at Luzerne Bank, but the payment was sent to an email address/U.S. mobile number that’s not linked to my account. What do I do?

You can either enroll the email or U.S. mobile number where the payment was sent (if you own that email or U.S. mobile number) or contact the sender to cancel the payment and send to your already enrolled email or U.S. mobile number.

I sent money to someone and want to cancel the payment, what do I do?

You can only cancel a payment if the person you sent money to hasn’t yet enrolled with Zelle®. To check whether the payment is still pending because the recipient hasn’t yet enrolled, you can go to your activity page to find your transaction. If it is pending, choose the payment you want to cancel, and then select “Cancel This Payment.”

If the person you sent money to has already enrolled with Zelle®, the money is sent directly to their bank account and cannot be canceled.

How do I receive money?

If you have already enrolled with Zelle®, you do not need to take any further action. The money will move directly into the bank or credit union account associated with the email address or U.S. mobile number you enrolled, typically within minutes1.

If you have not yet enrolled with Zelle®, follow these simple steps:

- Click on the link provided in the payment notification you received via text or email when someone sent you money.

- Select Luzerne Bank

- Follow the instructions provided on the page to enroll with Zelle® and receive your payment.

Once you’re enrolled, future payments will move directly into your bank or credit union account. You won’t need to do anything to accept them, they’ll just automatically be available in your account.

1 U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes and generally do not incur transaction fees.

Bank 2 Bank Transfers FAQs

Bank 2 Bank Transfers is a money movement tool that allows Luzerne Bank customers to transfer funds between your Luzerne Bank accounts and your accounts at other U.S financial institutions.

General Questions

Q: How does Bank 2 Bank Transfer work?

A: We process Electronic Funds Transfers (EFT) via the Automated Clearing House (ACH) secure network. We submit a request to the ACH network to transfer funds between the accounts you've specified. ACH then uses its secure channels to complete the transaction.

Q: Are there limits on how many transfers I can make?

A: There are limits on both the number of transfers and the amount of those transfers per banking day.

- $1,000.00 IN - 5 times a day (equaling $1,000.00)

- $1,000.00 OUT - 5 times a day (equaling $1,000.00). $2.00 Fee/per

Q: Can I transfer money internationally?

A: No, this feature is not available.

Q: Is this product available for business customers?

A: Business, Trust, Investment, and Retirement-related accounts are not eligible for any Bank 2 Bank Transfers.

Q: Can I transfer funds from my Luzerne Bank account to third party Non-Luzerne Bank Account?

A: The Bank 2 Bank Transfers service cannot be used to transfer funds to third parties or to or from an account that is held or owned by a person other than you.

Fees and Charges

Q: How much does Bank 2 Bank Transfer cost?

A: Transferring funds into your Luzerne Bank account (an Inbound Transfer) is free. There is a $2.00 per- transfer fee to move money from your Luzerne Bank account to another Financial Institution (an Outbound Transfer).

Q: Does the external financial institution ever charge for this type of transaction?

A: They might. Your external financial institution would be responsible for notifying you of any such charges.

Enrollment and Setup

Q: How do I get started?

A: You must first be a Luzerne Bank online banking user. You may use the Luzerne Bank online banking Message Center, or stop by any of our branch locations and request the Bank 2 Bank Transfer service. Once you have been approved you will receive an email from our Electronic Banking Department, and you will notice the new Bank 2 Bank Transfers menu option under the Internet Banking services tab.

Click on the Bank 2 Bank Transfers link, review the information and click Enroll. Review the Service Agreement and check I Agree and click on Submit.

On the next screen you will add the non-Luzerne Bank accounts you want to use with this service by providing the bank name, ABA Routing number, account number and selecting if the account is a checking or savings account. Once you submit this information, a small, random-amount deposit is made into your non-Luzerne Bank account within two days. You will then return to Luzerne Bank online banking to verify the amount of that deposit within three days. You will not be able to make transfers to or from an account until it has been verified.

Q: What is an ABA routing number?

A: The ABA routing number is an identification number assigned to each financial institution and each branch office. The ABA number is a 9-digit number found at the bottom of your check, usually on the left-hand side.

Q: Why do I have to verify my external accounts?

A: In order to protect your security and maintain the integrity of the payments network, the account verification procedures are safeguards that help us ensure that you have legitimate access to the non-Luzerne Bank account.

Using Bank 2 Bank Transfers

Q: How do I transfer funds between my enabled accounts?

A: Click on the Bank 2 Bank Transfers link on the sub-menu under the Internet Banking tab. You will be presented with the New Transfer screen where you will select the account to transfer from and to, enter the amount, Select the frequency, select a date, and finally click Submit.

You'll be brought to a confirmation screen where you'll be given a confirmation number for your transaction.

You can review Pending transfers by clicking on the Pending Transfer link in the navigational menus at the top. You can also view your history of completed transfers by clicking on the History link.

Q: What should I do if I want to cancel a Bank 2 Bank Transfer request?

A: You can edit or cancel a transfer before it has been processed, however we process transfers frequently during the day. Once your Bank 2 Bank Transfer request has been processed, you cannot cancel the transaction. Your best bet is to create a second transfer between the same two accounts sending the funds back to their point of origin (in effect reversing your first transfer).

Q: How long does it take for the funds to be available to me?

A: A regular Bank 2 Bank Transfer will take one to two business days to complete.

Q: If a recurring transfer date falls on a weekend or holiday, when will the transfer take place?

A: The transfer will originate on the first business day following the weekend or holiday.

Q: Can I set up a future-dated or recurring Bank 2 Bank Transfer?

A: Yes. You may schedule a transfer to take place on a future date. You may also set up a recurring transfer by entering a frequency, start date and end date.

Q: Can I transfer money to pay loans/mortgages at Luzerne Bank or other Financial Institutions?

A: Not at this time. Remember – you can transfer funds to make loan payments at Luzerne Bank with Bill Pay for other financial institutions.

Q: What accounts are eligible for Bank 2 Bank Transfer service?

A: Examples of eligible accounts types are: Consumer checking accounts, savings accounts, Money Market checking and Money Market savings accounts held at any Financial Institution that is able to accept ACH transfers.

Q: Can I make a Bank 2 Bank Transfer from my Luzerne Bank Mobile App?

A: After you have enrolled for Bank 2 Bank Transfers and completed the process of adding a non-Luzerne Bank account within your Banno, the non-Luzerne Bank account will be listed under the Transfer option within your mobile app.

Q: Who do I contact if I have any questions regarding Bank 2 Bank Transfers Service?

A: Please email all your questions to Bank2Bank@pwod.com or give us a call at 800-447-9464.

Bank Safely with Luzerne Bank

This is spotted when you see "https" rather than "http" at the beginning of our web address. You may also notice the address bar is green. This means the site is secure and encrypted.

Here's How You Can Help:

- Use an unique complex password with a mixture of numbers, special characters, and capital letters.

- If you are suspicious about a Luzerne Bank security issue, call us at 1-800-447-9464 or contact your local branch.

- Always "log out" from your online account at the end of a session.

- We will never contact you in any way for your banking password, pin number, or any other sensitive information through an email or phone call. Never give out this information!

And, we want to help you be safe everywhere online, not just when using the Luzerne Bank website. Here are some additional tips to help keep your information and accounts secure:

- Always keep your computer's operating system and anti-virus software updated. These updates are your first lines of defense in protecting your system. You should run scans on your computer at least weekly.

- Think before you click. Navigating to unknown/untrusted hyperlinks is one of the easiest ways to encounter malicious software. Always hover over a link before you click on it to see where it will take you. If you believe the link is secure, navigate to the site manually through your web browser, rather than by clicking the link.

- Be skeptical of Email attachments. They can carry malware and viruses. Even if the message is from someone you know, the person's account may have been hacked. Scan attachments before you open them.

- Protect your personal information. People often attempt to use social engineering to get others to reveal personal details online. Be especially wary when using message boards and social media sites.

- Don't use open Wi-Fi. With no password or encryption, open networks aren't secure.

- Back up your files to prevent losing them if something happens to your computer.

- In addition to using strong passwords, create a different password for every site. Many people tend to use the same username and email address for all their online activity. This information is highly visible and normally is one half of a site's authentication process. Using multiple, strong passwords can go a long way in helping to prevent your accounts from being compromised.

- Surf smart: Aside from hyperlinks and email attachments, malware and viruses also can be disguised as pop-up windows. Some sites will attempt to corner you into clicking "ok" to run a scan or install some type of software. Don't click – and navigate away from these sites.

- Beware of ads. They're how most malicious software ends up infecting people's computers. These ads may look legitimate but can trick users into clicking/installing something that is dangerous.

- Ignore infection warnings: These "warnings" often will come to you via emails or pop-up ads that prompt you to install some kind of free software, which, in turn, is malicious.

What is Peer-to-Peer (P2P) Payment Fraud?

Consumers often fall victim to P2P payment fraud when they send funds to the wrong person, often the perpetrator of the attack, who does not hold up his/her end of the transaction. This is due to the fact that the perpetrator is often running a scam.

Another, more rapidly growing, attack style of P2P payment fraud is in the form of an account takeover. An account takeover happens when a user’s credentials are acquired by the fraudster and then used, impersonating the victim, to conduct transactions from the bank account or application.

How to Prevent P2P Payment Fraud:

1. Activate two-factor authentication with P2P payment applications.

2. Monitor accounts and set up alerting. Consumers will want to monitor items such as: Dormant accounts suddenly moving cash in and out, unusually high dollar amounts sent, new user/contacts added and change in contact method (phone number, email address, physical address, etc.).

3. Use smart mobile phone practices: Create a strong lock screen password that is hard to guess, avoid connecting to public/open Wi-Fi and keeping all application up-to-date.

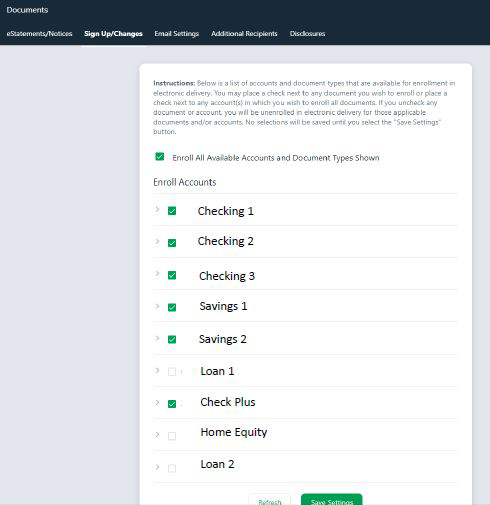

- Sign into your Internet Banking Account

- Click on Accounts

- Select an account

- Click on the Statements icon

- Click on the Sign Up/Changes option

This will show a list of accounts that can be selected to receive eStatements (see below)

- Check the box net to the accounts that you want to receive eStatements for

- Click "Save Settings"

- Read and agree to the "Terms & Agreement Disclosure"

- You are now set up to for eStatements. You will receive an email indicating that you have enrolled, or you have made changes to your accounts set up for eStatements.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Ipsam tempora recusandae mollitia inventore fuga quaerat totam id, delectus autem veritatis, tenetur minus provident qui iure in, cupiditate, atque odit unde dolores! Suscipit ea quaerat aliquid cupiditate temporibus eos repellat saepe.